Shares

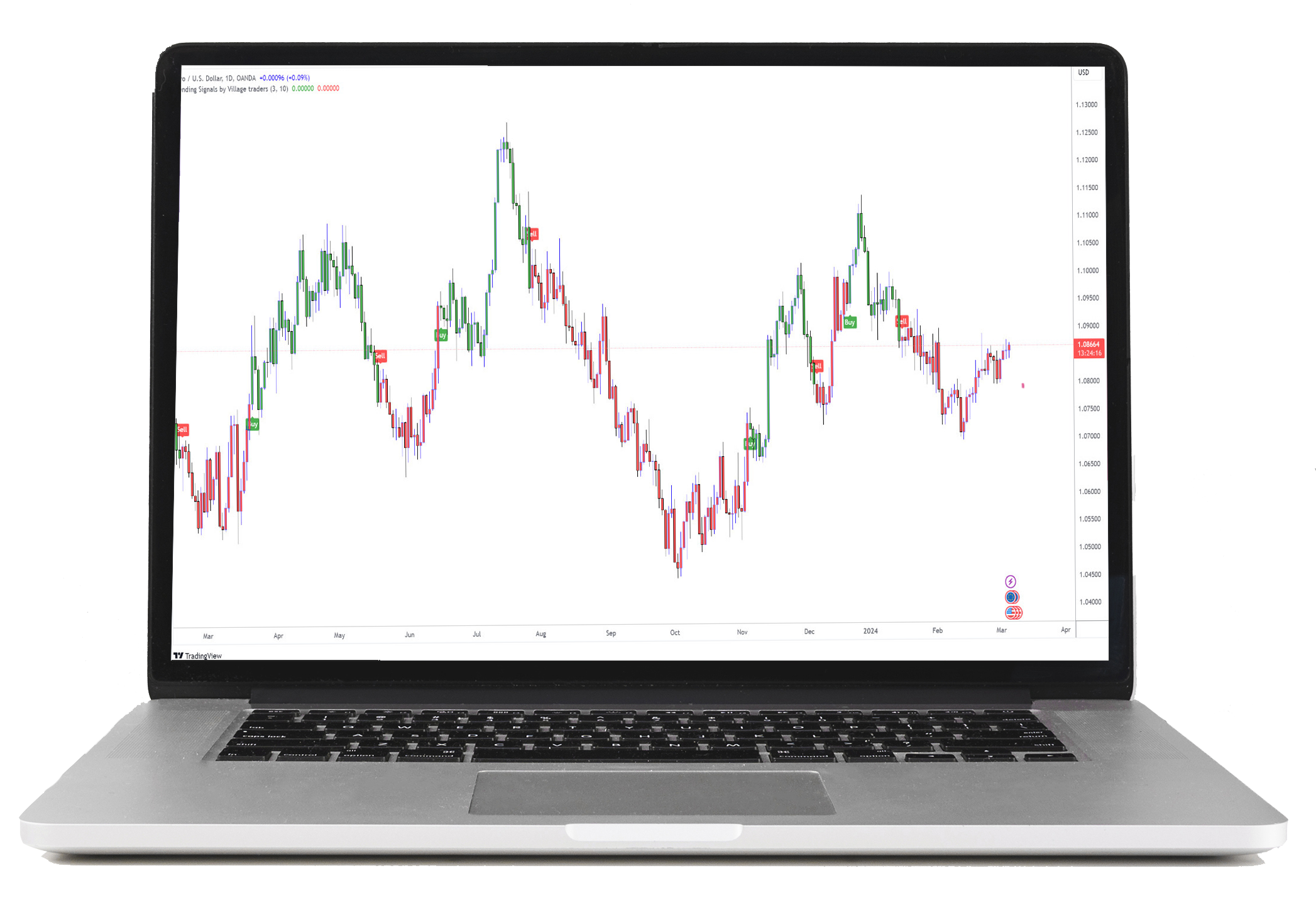

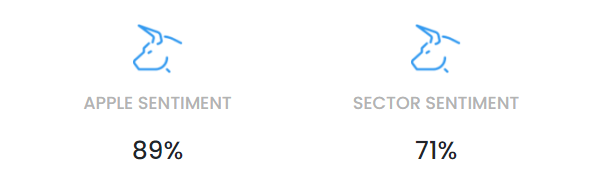

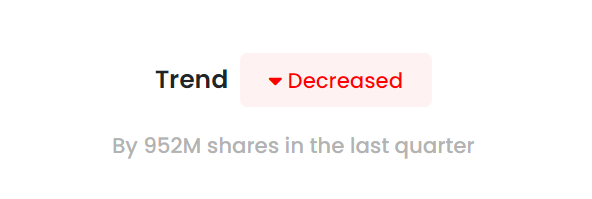

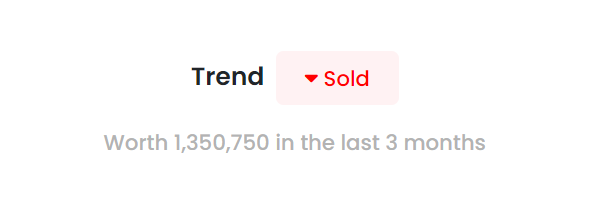

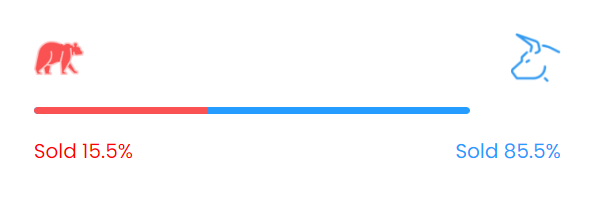

At Banyan Grow, enjoy commission-free trading with leverage on thousands of CFD stocks featuring competitive spreads. Explore over 2000 equities from major and minor global markets. Easily buy or sell individual shares according to your trading strategy and risk appetite.